CES 2013: The TV Manifesto

CES 2013: The TV Manifesto

The Battle for the Living Room is OVER—the War for the Consumer is ON!

The reality has begun to sink in: The home is part of a larger war involving engagement of the consumer -- and companies battling just to dominate consumer engagement in the living room are going to lose the bigger war. The end-game is clear: Companies must engage the consumer both in the home and mobile and have devices that are not location-locked.

This shift in targeting consumers while mobile or in the home was the most significant takeaway from CES 2013. Before the show, the expectation was for thinner, greener TVs with better user interfaces to be the show highlights. Coming out of the show -- while the TVs are bigger, thinner and greener – numerous TV companies highlighted their improvements in their TV set user interfaces (UI). However, this focus means that they are still targeting the battle for the living room, and are not well positioned in the larger consumer war.

This is a significant shift that has taken place in the past 20 years, when TV manufacturers and consumer electronics (CE) companies ruled the home and the consumer.

Just 20 years ago, when analog devices such as VHS players were dominant in living rooms, and devices were not connected to the Internet or to each other, the CE companies were household brands – Sanyo, RCA, Sony, Panasonic, Magnavox, Philips, Zenith.

Starting a decade ago, PCs started appearing in the living room and the race to put connected devices in the hands of consumers began. With clunky connected solutions (remember the rack-mounted Media Center Edition PCs from Microsoft?) creeping into the living room, the concept of“tele-webbing” was born.

The race to connect the consumer in the living room was on, and the device with the pole position? The TV.

So what did the TV industry do to respond? They began putting Ethernet jacks in their premium TV sets five years ago, and just three years ago, major retailers such as Best Buy were proudly promoting that every 40” or larger TV would come with an Internet connection.

To go with the Internet connectivity, the TV manufacturers needed a compelling, easy-to-use UI. However, UI was not a core competency for any global consumer electronics company. Most of the UIs were simple and limited to some form of electronic programming guide (EPG) licensed from Rovi (who bought the patent portfolio to most TV EPGs). Adding a new, interactive UI was not a strength of any CE company. Most of the UIs shown at CES over the past three years were clunky, and the big upgrades were more focused around adding a web camera for Skype, service partners such as Netflix or Hulu, or being able to see YouTube videos or check a Facebook page. The upgrades were largely iterative.

At this past CES show, much of this remains unchanged with respect to iterative additions. However, in the meantime, while the TV industry slowly moved toward capturing additional consumer eyeball time with non-TV content, the PC and mobile industries have moved significantly faster.

As expected, software and UI companies in the United States are familiar with software upgrade cycles, which are typically faster than hardware upgrade cycles. Those cycles, coupled with the computing power increases, pricing curve decreases, and the emergence of feature phones into smart phones, have driven consumer behavior become more mobile, and not just in front of a PC. The emergence of tablets, with 8” to 14” screens, have also enabled more mobile computing.

Because consumers today are now familiar with being able to communicate, socialize, consume, purchase or entertain with devices such as phones or tablets, the pole position of the TV as the center of a consumers’ entertainment world has diminished.

While the TV and consumer electronics industry has tried to move into the digital world, the mobile world has taken advantage of the transition of analog to digital to move entertainment out of the living room and onto alternate devices.

As a result, consumers have become familiar with watching TV on a TV while “second screens” in their hands are typically phones, tablets or notebooks. This means that the opportunity that the TV industry had just a decade ago has been lost to the phone, tablet and laptop industries.

The silver lining for the TV and consumer electronics industry? The opportunity to partner and avoid the risk of being further marginalized as the “dumb” screen.

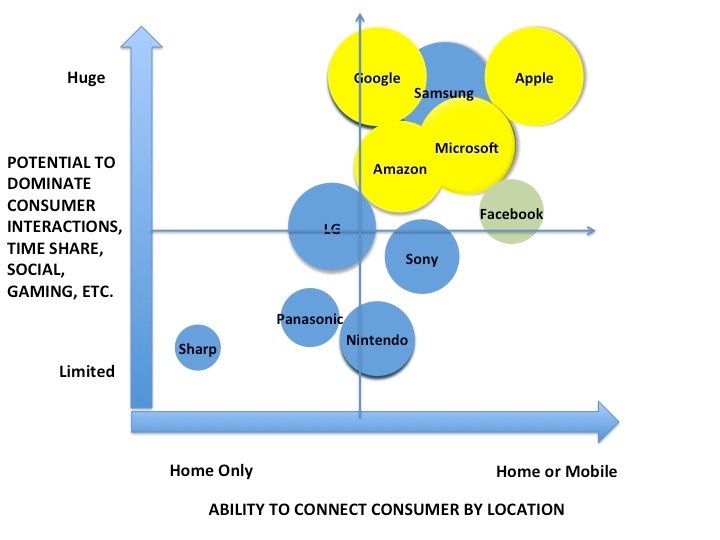

Table 1: Current and Future Consumer Leaders (traditional CE manufacturers in blue, PC/software/mobile companies in yellow, other companies in green)

Table 1 above shows the companies in the new pole position

for consumer engagement. The mobile, tablet, and laptop companies are in the

top right, and the majority of consumer electronics companies are in the bottom

left. There is much more company-level discussion and a breakdown of this table

later in this document.

The growing install base of non-TV devices already have comfortable, familiar UIs, such as devices from Apple, Microsoft and Google (and its Android partners), and to a lesser degree, Amazon. Consumers are used to these platforms/devices not only within the house, but also in their mobile lives. The TV then becomes a connected, but somewhat “dumb” device to which consumers can direct content to that screen, using a smart, connected other device.

Within DWR’s survey panels in the past, two trends are consistent:

1.Consumers have more and more devices (screens) in their hands from companies such as Apple, Google, Microsoft and Amazon, such as phones and tablets.

2.Consumers have not been demanding (at least in the U.S.) for “Where is my tablet from Panasonic?” or “Where is my Sharp smart phone?”

These trends strongly suggest that, while a company such as Sharp or Sony may improve its own UI for its TV sets, it’s simply not enough. The end-around for the living room has passed them by on the relevance scale to mass markets.

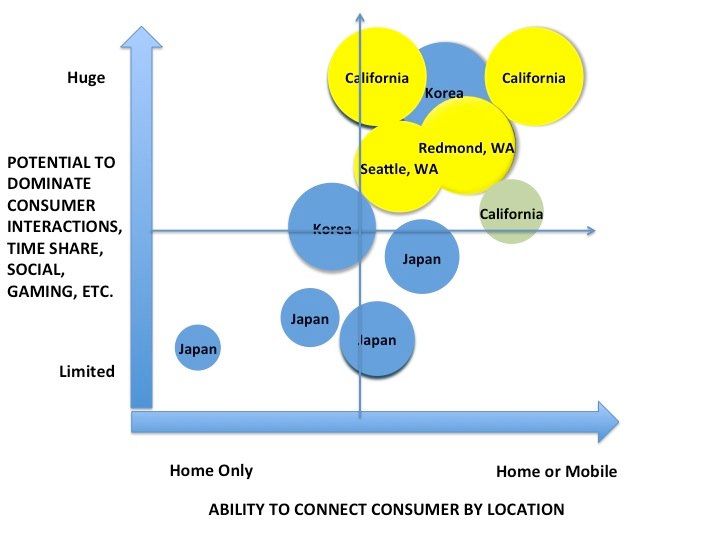

Another filter on Table 1 provides the alternative perspective shown in Table 2.

Table 2: Current and Future Consumer Leaders by country or state of originThe talent base for mobile, tablets and laptops, as well as leaders in software and UI, are all located in either the states of California or Washington. As the media industry has gone digital, the traditional TV and CE companies (based predominantly in Japan) have struggled.

This is not to suggest that there is not hope for the Japanese companies – but, a big BUT – corporate culture must change with respect to the role of engineers and partnering with non-Japanese companies.

Traditionally, Japanese companies do not move quickly, while many in the U.S. move quickly – as in daily. This means that not only do Japanese corporate cultures (such as at Sony, Panasonic, Sharp and Nintendo) have to acknowledge that they need help, but they also need to figure out how to partner with companies who specialize in UI and software, as well as services such as cloud computing.

The Korean companies remain the wild card in this consumer equation. Both Samsung and LG have significant currency tailwinds, and they have been putting it toward increasing research and development budgets. By virtue of blunt force, a company such as Samsung may figure out the magic of UI and become the first non-U.S. company to do so, but it lacks a key component. To understand how to truly distribute digital content, such as video games or movies, there is a highly vested interest to have some skin the game. If Samsung were to launch a significant effort to fund and create movies or video games, it would better understand the needs of content owners and be able to tailor its vast resources to creating products aligned with those interests.

This is a criticism often leveled at companies such as Google as well, but at least with both Apple and Google, both have courted and supported reams and reams of third-party content. This isn’t true of Samsung to date.

Company-Specific Implications

As the war for the consumer evolves, there are companies who will thrive or struggle based on hardware, software, content and services. Those below are a snapshot of those entries, and implications for a tablet or mobile device-driven consumer scenario. The companies have been broken up based on which quadrant they are positioned in Table 1, followed by other future potential players not in the quadrant.

Keep in mind that companies will move throughout the quadrants as the year progresses. This will be driven by a series of filters, including:

1.New hardware announcements

2.New distribution deals

3.New content aggregation or creation news, in TV, news, music, movies, other video, photos, video gaming, real-money gaming, or other consumer-generated content

4.New social communications networks or tools

5.New software product offerings, including utility-driven consumer offerings.

6.Improvements in transactional capabilities

7.Longer term initiatives in remote medical diagnostics and collaboration with health care infrastructure partners.

TOP RIGHT QUADRANT—Huge potential to dominate consumer time, both in home and mobile

Facebook is the social layer woven throughout devices, and is not location specific. While there is criticism that “Facebook is for my parents but not for me,”it is not well-founded. The numbers for Facebook remain massive, and consumer behavior means updating Facebook statuses, checking others updates, etc., no matter where a consumer is – at home or mobile.

As a result, Facebook is clearly lodged in the living room on phones, tablets and laptops. To a lesser degree, Facebook is on TVs as part of a connected UI through a TV manufacturer. Where Facebook is more interesting on TV is logging into Facebook for your Xbox Live account, playing an Xbox Live game and being able update your status after playing a game, or being able to share a recently watched YouTube video on Facebook. It is arguable that you can do that on YouTube with Facebook on any device, but for the sake of this discussion, it reiterates that Facebook is already in the living room.

The potential for Facebook looms as large as any company out there today since it already dominates in social. While it has a significant presence in gaming, if the movement to HTML 5 gaming in the next two years happens, it opens up an even deeper relationship for Facebook with consumers on multiple screens.

Can Facebook do more? Sure, it could partner with Rovi to become part of the Electronic Programming Guide (EPG), or become an interactive ad for what TV content your friends are interested in and might be watching. Recommendations from friends for content -- any content -- have proven to be wildly powerful, and Facebook user data combined with a TV guide is a pretty compelling combination.

Facebook should look to partner more with the TV guide food chain – from Rovi, to Dish and DirecTv, to Comcast and other cable companies. Even if Facebook cannot become part of the EPG, it could still become part of a separate app that shows friend recommendations and become involved in interactive discussions such as polls and voting on TV content.

Amazon

Amazon should likely be split a couple ways, including:

· Amazon the hardware company . The Kindle Fire and its future iterations will likely include either a phone and/or a TV panel. As a hardware company, Amazon likely has moderate aspirations – seed the market, own the e-book vertical, and inch into other adjacent verticals such as music services or TV/movie content. Amazon has a main goal: keep the consumer in the Amazon universe of buying or consuming, so that means being a multi-media services and content company.

· Amazon

the TV/movie/video game content creator

. This strategy is simple: every other content creator

feels better making content for a piece of hardware and service (such as

Amazon) when Amazon has some skin in the game. This means they understand the

morphing needs of content creators without having to constantly ask for and be

completely reliant on feedback from their developer community.

Microsoft

Similar to the discussion around Amazon, Microsoft needs to be sub-segmented:

· The

Interactive Entertainment Business (IEB) unit, including the Xbox teams

. This means a reset of potential power

within the traditional Microsoft divisions as the next-gen console is prepared

for launch likely later this year. Given that the underlying kernels for the

console -- code-named Durango -- are the same as those running the Windows

Phone and Windows 8 operating systems, cross-platform functionality should be

as easy for Microsoft as it is for Apple. This also means that Microsoft has

one big target in the living room with Durango: Apple (i.e., not Sony or

Nintendo).

At a more complicated level, the internal challenges of “who is calling the

shots?” will be significant as Microsoft tries to roll out cross-platform

services such as Xbox Music. Who controls Xbox Music? An independent team, or

the Windows 8 department, or Windows Mobile, or IEB? Let the power struggles

continue in Redmond.

· Windows 8 tablet/PC/laptop OS teams . These groups have been laying the groundwork by rolling out Windows 8, and tablet penetration is a key objective (beyond obvious objectives such as an enterprise PC upgrade cycle). The capabilities for consumers to move content from a Windows phone to a Windows tablet to a TV, much of the capability of its “Smart Glass” marketing, has been in anticipation of adding a console/set-top box into the equation, likely in 2013.

· Windows Phone . This team has been pounding away trying to make inroads against both the Android-based phones and the iPhones, and it has been all uphill. However, from a second-screen perspective, this screen is still highly strategic as a secondary source of content and controlling the consumption function on a TV.

So will Microsoft then make its own TV set? It could likely extend its current operating system for basically a “lite” version where most of the brains and power of the TV would be handled by the cloud. Possible? Yes. Likely? No. Multiple versions of Durango by region (think some with TV tuner cards included, various sizes of storage) are highly likely.

Further, Microsoft has been experimenting with selling the Xbox similar to selling a phone: $99 with a two-year commitment to Xbox Live. Microsoft could package a version of Durango in this fashion, but would not be popular with Triple A game developers who need hardware profile assumptions for game development. If those profiles changed every two years or so, development would have to be heavily reconfigured.

Apple

Apple is split in a similar fashion to Microsoft:

· Apple iPhone . This product upgrade cycle of new iPhones every 18-to-24 months allows Apple to continue to innovate on second screen possibilities, including navigation for Apple TV. Apple has continued to tweak and try new things using its iPhones and Apple TV such as flicking or sending content (photos) from an iPhone for viewing on a TV. The growing install base of iPhones worldwide is a massive advantage for Apple when discussing control of the consumer not only while mobile, but also within the home.

· Apple iTunes and App Store . This is Apple’s content aggregation approach on the iTunes side for TV and movies, as well as games and apps for mobile and home utilization/consumption. There appears to be zero interest in Apple becoming a content creator, but given its install base of devices, it is an attractive partner as an aggregator.

· Apple iPad . Similar to iPhone upgrade cycles, the role of the iPad just hammers home utilization no matter where the location. The iPad mini extends that approach, filling out a product gap based on screen size.

This analysis of Apple products and services begs the question of whether Apple needs to make an Apple-branded TV set. The business model case can be made from many perspectives, including its dominance over the food chain, its turnkey content already prepped for large-screen formats in iTunes and the App Store, and its familiarity with monitors and TV through Apple TV. However, the contra-arguments remain: TVs are closer to 5-to-7-year replacement cycles and do not hold up well with typical Apple 40% hardware margins. Further, Siri does not yet work well at distance for voice commands in the living room (unless, of course, the use case is on handhelds or tablets).

The concept of Apple TV as a hobby remains, and Apple not only has not been able to secure numerous over-the-top content deals, but it also can still dominate the consumer in the home or mobile given the install base or hardware. One piece of news we believe critical to Apple’s future success with AppleTV is simple: It must sign more content deals for over-the-top delivery of content from multiple partners, such as HBO.

Google is sub-segmented as its operating system efforts have spanned multiple devices. Google’s growth with Android-based devices has been impressive, but critics have remained, focusing on a consistent argument – why focus on an Android OS-based device when making an OS is not the primary business of Google? Criticism aside, the non-search segments include:

· Android

OS for mobile

,

including Google Phone. Google clearly has had success in this arena to Apple’s

and Microsoft’s chagrins, and has been hugely driven by support from Samsung as

a partner. Growth in Android-based phones is surpassing Apple’s growth rate in

smart phones.

The challenge for Android is inherently a significant challenge for content and

services companies. Because the Android market is widely fragmented by OS

version and phone features, it presents a programming challenge. Further, the price

points on Android phones are very wide, meaning the likelihood or predilection

for an Android owner to spend additional money for content or services over the

phone is challenging. That said, Android will have a significant role with

consumers, mobile or at home.

· Android OS for tablets . Welcome to the low-cost alternative to buying an iPad. The environment for apps on Android phones and tablets has been described as “the Wild, Wild West” and wide open, meaning curation for quality apps does not exist. However, Android-based tablets (including Amazon’s Kindle line) will likely remain in second place in market share behind Apple unless Windows 8 tablets have a significant rise. Again, Google tablet penetration means a significant role with consumers both mobile and in the home.

· Android

OS for TVs

. The

efforts behind Google TV have ebbed and flowed. While making a splash over the

past few years at shows such as CES via partnerships, Google TV has remained

muted. At CES 2012, partners such as Sony, LG and Samsung all introduced a few

models of TVs featuring Google’s OS. However, at CES 2013, there were few new

products announced, yet multiple Japanese and Korean TV companies made a point

to call out and highlight what a great partner Google was, how they enjoyed

working with them, etc. It bodes well for Google for continuing to grow its

presence in consumer devices used while mobile or in the home.

During CES 2013, Google was the one company mentioned onstage in nearly all the major press conferences without holding one itself, while Apple was the company mentioned off-stage in the crowd in nearly all the major press conferences without holding one itself. Strange days, indeed.

Samsung

Samsung has potential to play in the consumer space simply due to market share. It is already the top handset maker worldwide, the top TV manufacturer worldwide, and is gaining ground with its Android-based tablets and laptops.

However, Samsung stumbles with UI, software, and content aggregation outside of Korea. There are vast sums of Won being spent trying to solve some of these issues outside of content aggregation.

The question of Samsung as a content aggregator or creator remains unanswered – aggregation seems to be the answer for now, but the content creation question remains. Samsung has cash, but seems reluctant to spend on outside of research and development, as well as marketing.

Samsung is already in consumer living rooms with its TVs, and in some hands at home and mobile with its phones. It is impressive that Samsung can compete for market share in so many different areas (all the way to home appliances), but as one commenter from CES said, “have you seen a good working UI from (Samsung) yet? Let me know when that happens.”

TOP

LEFT QUADRANT—Huge potential to dominate consumer time, somewhat in home and

not well-positioned in mobile

LG

LG in many ways mirrors Samsung with TV production, panels for tablets, and some phone and appliance production. However, again, it stumbles on UI, software and content.

LG is smaller than Samsung in all areas and has fewer products spread across fewer areas. And, while some of the UI presentations in Las Vegas looked good on stage, it remains an isolated strategy.

Longer term, LG could be one of the first to present a unified home system where your fridge, stove, washer, TV, air conditioning and electricity are all controlled by a single LG device, but may be felled by a bigger problem -- vertical integration where that home networked group works only with LG devices. Not many homes are built in such a fashion, and there is very little evidence to suggest any early actions to create cross-device software and integration solutions.

BOTTOM RIGHT QUADRANT—Limited potential to dominate consumer time, currently in home and with some presence in mobile

Sony

Sony has made some sound business decisions, such as looking to partner for TV panel production instead of manufacturing them, and some baffling business decisions, such as treating DeNA as an investment instead of a potential partner.

It has continued to muddle through phone production, and there is plenty of aging speculation that a PlayStation phone could finally be coming now that the Sony-Ericsson agreement has ended. However, Sony will require a massive marketing effort to gain market share outside of Japan in the smart phone market.

Sony has continued to produce Sony Vaio computers, and featured several tablets at CES, but, again, there seems to be little traction for theses devices outside of Japan.

Sony has taken a more network-centric approach, with connected devices meaning connected to the Sony network, not necessarily to each other. The only exception to this is integrated gaming with a Sony PS3 console and a PS Vita handheld — and this exception is limited at best, and more of a technological capability demonstration.

The challenge for its network-centric approach is that, plain and simple, Sony has struggled creating a network with content and services. It has finally moved away from offering Sony-centric content, but the privacy data breach was a significant hit, and trust remains an issue to consumers. Simply being able to access consumer content in the cloud is not enough to stay competitive with Microsoft, Google, Apple and Amazon today.

Sony finds itself at an absolutely crucial crossroads —what does the Sony brand mean in an Apple-centric world? And what technological edge can Sony exploit to drive a new generation of products and services? Things are mighty dark for Sony in Tokyo these days.

When might it get brighter? Sony recently announced a

February 20th press conference in New York City, with expectation of

a PlayStation 4 console. Expectations are that Sony will attempt to move, in

essence, higher up in the quadrant to capture more consumer time with an

improved social layer. Further, it could still announce a new PlayStation

phone, too, moving Sony in a potentially more meaningful shift further right in

the quadrant. However, Sony has a moniker that reads “Make.Believe.” We remain

on the sidelines on Sony’s

future until we “See.Believe.”

Nintendo

Nintendo continues to try to innovate and differentiate with offerings such as WiiU TV, but the uptake rate from consumers is too early to measure. Nintendo has a storied legacy of remaining focused on what it does extremely well --- making great games. While there is plenty of public criticism of what Nintendo is not , Nintendo has not wasted time and money on a large scale trying to become something it is not.

However, Nintendo continues to explore new possibilities at its own pace, and partnerships with content providers or aggregators such as Netflix have been announced. It is a WiiU box specific strategy – not tied to any smart phone or tablet hardware providers.

This likely means Nintendo will continue to be, well, Nintendo, and likely out of the second screen discussion beyond using a WiiU tablet as a content controller.

BOTTOM LEFT QUADRANT—Low potential to dominate consumer time, currently in home and not well-positioned in mobile

Panasonic

Panasonic continues to shift its business models away from competing for the living room. To its credit, it has focused on its battery business, and reapplied some of its plasma-panel production capabilities to serve the solar panel market. It is unlikely to make the jump to create a presence in the mobile phone or tablet markets at any scale.

Sharp

Sharp demonstrated an improved UI experience at CES, and it will work well for households that do not have other connect devices. However, that market size is small.

Its opportunity being pushed at CES was 60”, 70”, 80”and 90” TVs. They looked phenomenal. However, how big is the market opportunity for very expensive, very big TVs? Limited again.

Sharp has a future in TVs and tablets, but as a panel provider for companies such as Apple. Its IZGO technology demonstration at CES was impressive, and Sharp deserves kudos for partnering with Corning on panel technology. Sharp is arguably the best panel producer in the world today, and will continue to drive the company.

COMPANIES NOT YET IN THE QUADRANT

Aereo

Aereo is included in this conversation because they are, as DISH has said, “trying to give consumers what they want.” In this case, it is giving consumers access to content and making it easy. Aereo is offering consumers a chance to rent an individual TV antenna to be able to access its local content over the air and through the Internet to any location.

It is an interesting workaround to the traditional conditional access approach to paid TV content. It also enables TV to be consumed on something other than, say, a TV. It sounds funny, but it aligns with changing consumer behavior for the 18-to-30-year old crowd. They are used to consuming content on a 15” or 20” screen, or even a 4” smartphone screen, so providing them access reiterates that TV does not have to be on TV, thereby lessening the importance of the traditional TV manufacturers who are not involved in the tablet/laptop/smart phone discussion.

Aereo not only works around some of the constraints of the current consumer delivery infrastructure, but could also be considered a form of unbundling. While more classic examples would be enabling consumers to buy ESPN directly through the web instead of having to have a subscription to a current cable or satellite provider, technology is enabling other workarounds such as Aereo.

DISH

DISH is in a tooth-and-nails fight with DirecTV and has been aggressive in promoting not only its new (last year) Hopper series but also its ad-skipping capabilities.

DISH has been aggressive in positioning itself as meeting consumer needs for simplicity, access, storage, and convenience. It wants consumers to access content stored on a set-top box anywhere, any time, and with or without ads. It is a powerful marketing push, but is also differentiated from DirecTV, which pushes content and numbers of high-definition channels. In other words, if you can not win the current battle, change the terms and pick a fight you perceive you can win.

To that point, DISH realizes that while it is a satellite company, it needs to deliver content to not only TVs, but also to phones, tablets and notebooks. It has been able to see beyond a connection to the back of a TV set, which positions itself in a decent spot as more consumers watch “TV” on tablets and phones. It is not landlocked to a legacy idea of the battle for the living room.

Netflix

Netflix is arguably already in an enviable position having successfully moved from a focus on physical disc rental to its online streaming service. As a result, Netflix simply wants to keep consumers happy, and subscribing. Netflix does not care if a consumer wants to stream content from Netflix on an Xbox 360, a Sony PlayStation 3, an iPad, a Macbook, a Windows 8 device, through a TV UI, or even on a phone.

As a result, Netflix is insulated from the consumer mobile-vs.-home locations. Netflix is already wherever the consumer is.

The main threat to Netflix is likely Amazon, not iTunes, at this point. Amazon Prime subscribers have access to a wealth of content to stream included with the subscription, and while it may not be early “window” release content, it often may be considered to have “good enough” content to keep consumers happy and consider canceling a Netflix subscription.

Twitter by-and-large has become a huge second-screen phenomenon by virtue of consumer empowerment. For example, a consumer could arguably skip watching the Grammy Awards show live on TV, but instead follow some key influencers on Twitter and learn in near-real time which artist won which award.

Granted, Twitter is not limited to being just a second screen for TV, but it has certainly become a required “tool” or service to have handy during other TV viewing events such as professional sports.

Most consumers today do no use Twitter on a TV screen via a remote keyboard, but instead use a phone, tablet or laptop. This again diminishes the prospects for a TV-driven user interface dominating a consumer experience without having some additional interactive software layer tied to a handheld screen of some size.

Zeebox

Zeebox is one of the early services that take advantage of the second screen concept in the living room. While it is not directly integrated with the content being consumed on the TV (can not play, pause, record, etc.), it is positioned as an enhancement to the content with a social, data, communications and transactional layer.

At one level, Zeebox will work on virtually any handheld, tablet or notebook device, but is more of an overlay rather than a consumption driver. Over time, as companies move from providing one to two or three screens that consumers will use, a company such as Zeebox will be an attractive layer to add in.>> Download the Printable PDF Here